- What We Do

- Understanding your audience

- Engaging new audiences

- Designing experiences

- Building loyalty

The state of the Bay Area culture market

أضف تفاصيلك أدناه

Download the full Audience Atlas Bay Area report

Fill in your information here to get an instant download of the full report, or read the key findings below.

Key findings

In 2023, the San Francisco Museum of Modern Art (SFMOMA) commissioned Morris Hargreaves McIntyre to undertake a new iteration of our 2017 Bay Area Audience Atlas. This was a targeted online survey of the adult population in all nine counties of the Bay Area, exploring the market for culture, defined as anyone who has engaged in any type of cultural activity in the last five years, or would be open to doing so in the future.[1]

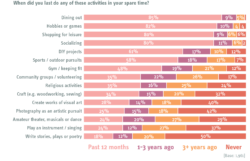

The survey allowed us to map the market’s past, recent and future propensity to engage with a wide range of art forms and leisure activities. It also provides a wealth of data on sources of information for cultural activities, involvement with community groups and the impact of the pandemic on cultural engagement.

Here are the key findings on how the Bay Area culture market has changed post-pandemic, alongside some initial recommendations on how to engage and re-activate these audiences:

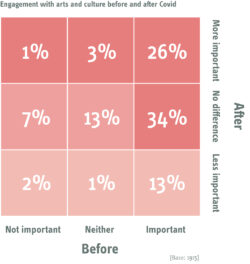

While people are generally less active in the market, art and culture are still as important to them as before the pandemic

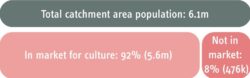

The adult population of the Bay Area increased slightly from 2017 to 2023, but this change was not consistent across counties and San Francisco’s population is still in a period of flux. Despite these changes the overall market for culture remained stable (92% in 2023 vs 92% in 2017), in line with Washington D.C (92%) but lower than other US cities and regions such as Boston (98%) and North Carolina (98%).

[1] The 2017 Bay Area Audience Atlas covered six counties (San Francisco, Marin, Alameda, Contra Costa, San Marco and Santa Clara) and the market for culture was defined as anyone who had been culturally active in the past three years.

The most notable change is that the culture market is generally less active than before the pandemic. For instance, although 77% of respondents had visited a movie theater in the past three years (making this the largest market in terms of current attenders) this figure has declined significantly from 81% in 2017. However, there is a large potential market who could be persuaded to return to a range of activities and venues, and for 8 out of 10 respondents, Covid made a positive or neutral impact on their engagement with arts and culture. This means that a compelling offer has the potential to reactivate audiences and encourage people to return.

Culture Segments provides a shared language for understanding the market

Culture Segments is our universal, sector-specific psychographic segmentation system for arts, culture and heritage organizations. Community-minded Expression, who are full of enthusiasm with varied and eclectic tastes, remain the largest segment in the Bay Area, with this proportion increasing significantly from 21% in 2017 to 27% in 2023. They were more likely to be in the current market for all events or art forms tested and there were no significant differences from the average in terms of location or ethnicity, making this a good segment to target across demographics.

But there is also scope to target other Culture Segments by thinking about which of them will have the most impact for you. For instance, Affirmation make up 17% of the Bay Area Culture Market, significantly higher than the figure of 12% recorded in 2017. They are conscientious and considered, and see cultural activity as form of self-improvement, a chance to learn as well as have fun. Targeted messaging, such as letting them know about events early or promoting the educational benefits of a visit, would help ensure your communications resonate with them.

We can build more meaningful connections by better understanding how people engage with community groups and organizations

The survey showed that there is a lot of competition for the market’s leisure time, and it is therefore more important than ever to understand visitors’ motivations for taking part in cultural activities. These insights can help arts organizations understand what people might want from a visit and how to compete with other activities, while also offering guidance on how to draw on people’s interest in these activities.

For instance, we found that over half of the market (51%) are involved in a community group or organization, with the most common type being an interest or hobby-based group (e.g. book clubs, crafting, gaming). This offers potential to reach out to these groups by promoting your organization as a place to meet and socialize with other like-minded people, or even offer spaces to host these types of groups. This would give people a reason to visit more often and would particularly appeal to Expression, who were significantly more likely than average to be involved in a community group or organization (64%) and appreciate any opportunity to connect with a large and diverse community.

For instance, we found that over half of the market (51%) are involved in a community group or organization, with the most common type being an interest or hobby-based group (e.g. book clubs, crafting, gaming). This offers potential to reach out to these groups by promoting your organization as a place to meet and socialize with other like-minded people, or even offer spaces to host these types of groups. This would give people a reason to visit more often and would particularly appeal to Expression, who were significantly more likely than average to be involved in a community group or organization (64%) and appreciate any opportunity to connect with a large and diverse community.One fifth of the market currently belong, as a member, to at least one organization, a figure which is significantly higher for those living in San Francisco. We found that one-off donations are the most common means for people to support an organization, followed by regular payments and volunteering time.

Most of those who don’t currently donate or have cultural memberships said they would consider supporting an organization, with Essence and Expression the Culture Segments most likely to become members. When we asked why they might become a member, the most-common response was ‘to support the organization’, followed by ‘to contribute to something I am personally interested in’ and ‘to make a difference’.

Outro

The market for culture in the Bay Area has remained stable but audiences are now less active than they were in 2017. By showing how audience habits have changed since the pandemic and digging deeper into people’s motivations for engaging with culture, this Audience Atlas provides a starting point for (re)engaging audiences in the region.

Download the full report at the top of the page for more insights and recommendations into activating the Bay Area market.

If you have any questions, or you’d like to talk to us about how we might be able to help your organization, please contact alexa.magladry@mhminsight.com.

- Engaging new audiences

- Understanding your audience